Condo Insurance in and around Wichita

Condo unitowners of Wichita, State Farm has you covered.

Condo insurance that helps you check all the boxes

- Maize

- Valley Center

- Park City

- Bel Aire

- Goddard

- Derby

- Andover

- El Dorado

- Newton

- Heston

- Hebron, NE

- York, NE

- Scottsbluff, NE

- Oklahoma City

- Tulsa

There’s No Place Like Home

As with any home, it's a great idea to make sure you have coverage for your condominium. State Farm's Condo Unitowners Insurance has excellent coverage options to fit your needs.

Condo unitowners of Wichita, State Farm has you covered.

Condo insurance that helps you check all the boxes

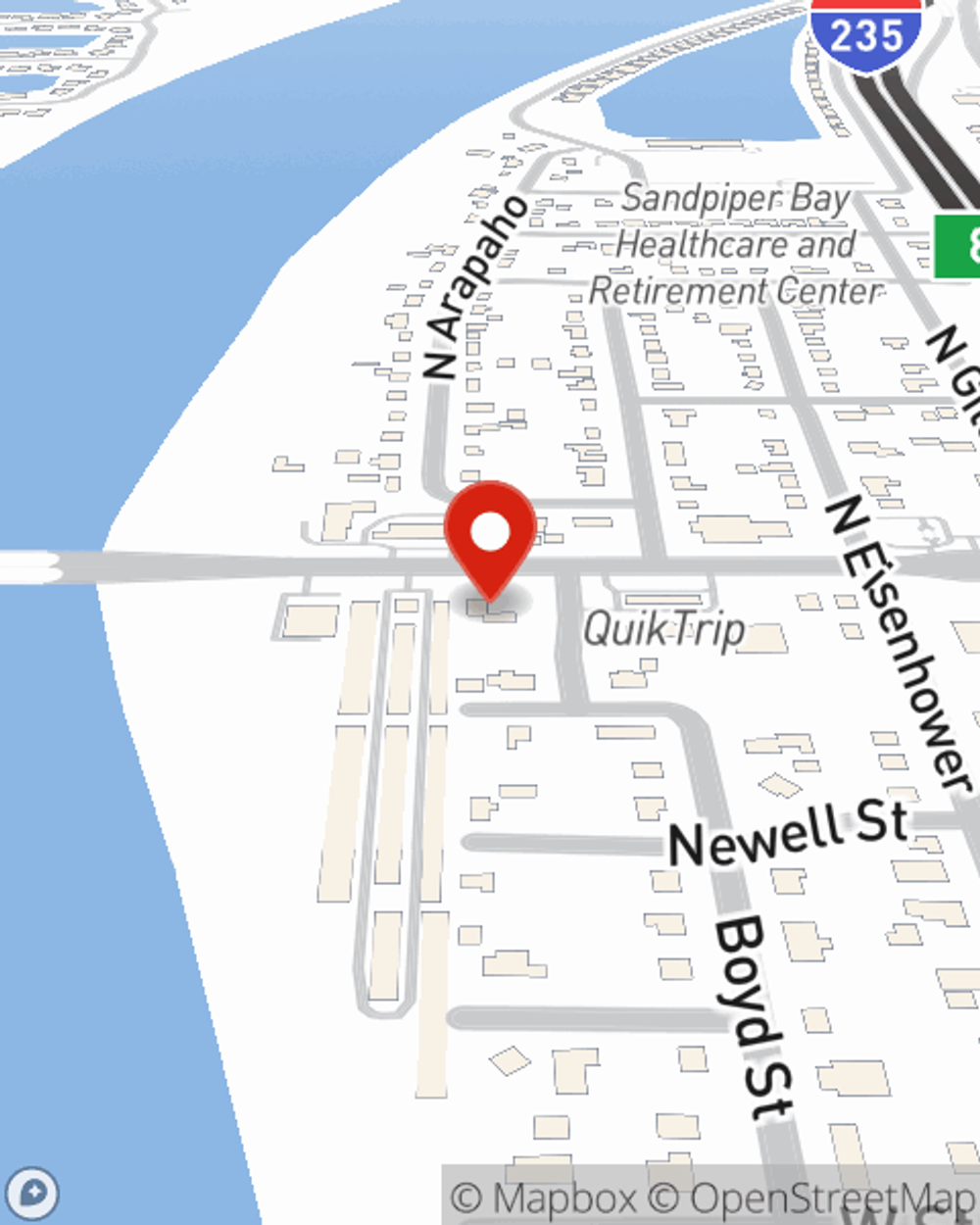

Agent Caleb Hanke, At Your Service

With this protection from State Farm, you don't have to be afraid of the unanticipated happening to your unit and personal property inside. Agent Caleb Hanke can help inform you of all the various options for you to consider, and will assist you in building a terrific policy that's right for you.

Wichita condo owners, are you ready to experience what a company that helps customers by handling thousands of claims each day can do for you? Get in touch with State Farm Agent Caleb Hanke today.

Have More Questions About Condo Unitowners Insurance?

Call Caleb at (316) 943-6494 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Caleb Hanke

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.